Vauld suspends withdrawals, trading and deposits

The decline in cryptocurrency prices has prompted Singapore-based crypto firm Vauld to suspend all withdrawals, trading and deposits on its platform and seek legal steps amid financial challenges. Traders and industry observers anticipate a "crypto winter" in the following months prompting several firms to tighten their books and streamline operations.

Facing financial challenges due to volatile market conditions which has led to significant amount of customer withdrawals in excess of USD 197 Mn since June 12, 2022 when the decline of the cryptocurrency market was triggered by the collapse of Terraform Lab's cryptocurrency - Celcius and Singapore based cryptocurrency hedge fund Three Arrows Capital defaulting on their loans.

Vauld had announced a reduction in headcount by 30 per cent as market conditions turned worse. In India too, some of the exchanges also had to suspend deposit and withdrawals, primarily due to incorporating compliance and KYC requirements as a TDS of 1 per cent comes into effect from July.

Source: Telegraph

Beta tumse na ho payega: GOI to Vedanta-Foxconn JV

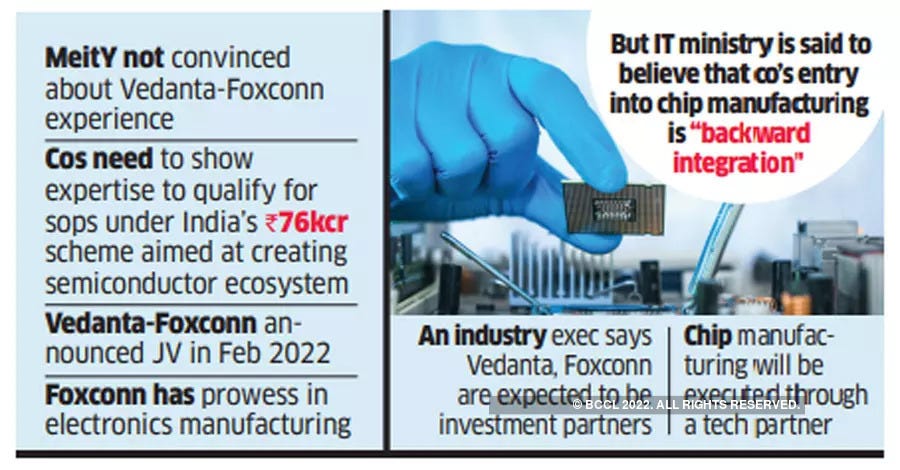

The Centre is "unsure" if the Vedanta-Foxconn joint venture has the "appropriate technical knowhow" for semiconductor manufacturing and fabrication.

The ministry for electronics & information technology (MeitY) wants Vedanta and Foxconn Technology Group to provide more details on how they plan to acquire the required expertise, or get a third partner with demonstrated technical capability

Source: ET

OneCard eyes unicorn status in BNPL mess, to raise $100 Mn

Mobile-first credit card startup OneCard is all set to become the 104th unicorn of India and 19th in the ongoing calendar year (2022) as it is set to raise $100Mn.

The BNPL mess

OneCard’s Series D round is coming at a time when the future of the buy now pay later (BNPL) platforms is shaky in the wake of a RBI diktat that bars prepaid payment instrument providers from offering non-bank credit lines.

We had covered the story on June 21

The company along with its competition Slice, Uni, Fi and others are busy figuring out their next moves.

OneCard ka dhanda kesa hai

For the uninitiated, OneCard offers first-time credit card users a virtual, cellphone-based card to build a credit score. It also enables an equated monthly instalment (EMI) facility for purchases of Rs 3,000 and above at an interest rate of 1.33% with a repayment tenure of 3-24 months.

OneCard offers credit cards in collaboration with banks, including IDFC First Bank, SBM Bank, South Indian Bank, Federal Bank and Bank of Baroda Financial. It currently has more than 600,000 users across the country.

Besides, it also runs a credit score tracking and credit management app called OneScore having 70 mn users. According to regulatory filings, the company earned Rs 10.78 crore in FY21.

Source: Entrackr

Drying crypto trading with 1%TDS

Warnings from Indian crypto exchanges that a controversial new transaction tax would erode trading are coming true, with volumes evaporating since the levy took effect. ZebPay, WazirX and CoinDCX -- suffered declines of between 60% and 87% in the value of daily trading immediately after the 1% TDS kicked on July 1.

Winter is coming

Those steep declines came from already depressed trading levels, as a combination of plunging prices, unfavorable tax treatment and difficulty getting cash onto exchanges combined to depress the once-hot market.

Crypto exchanges trade 24 hours a day, seven days a week.

While long-term crypto holders are still buying and selling, market makers and high-frequency traders are “gone,” said WazirX VP Rajagopal Menon.

Traders are also doing more peer-to-peer trading and migrating to so-called decentralized exchanges.

Source: Bloomberg